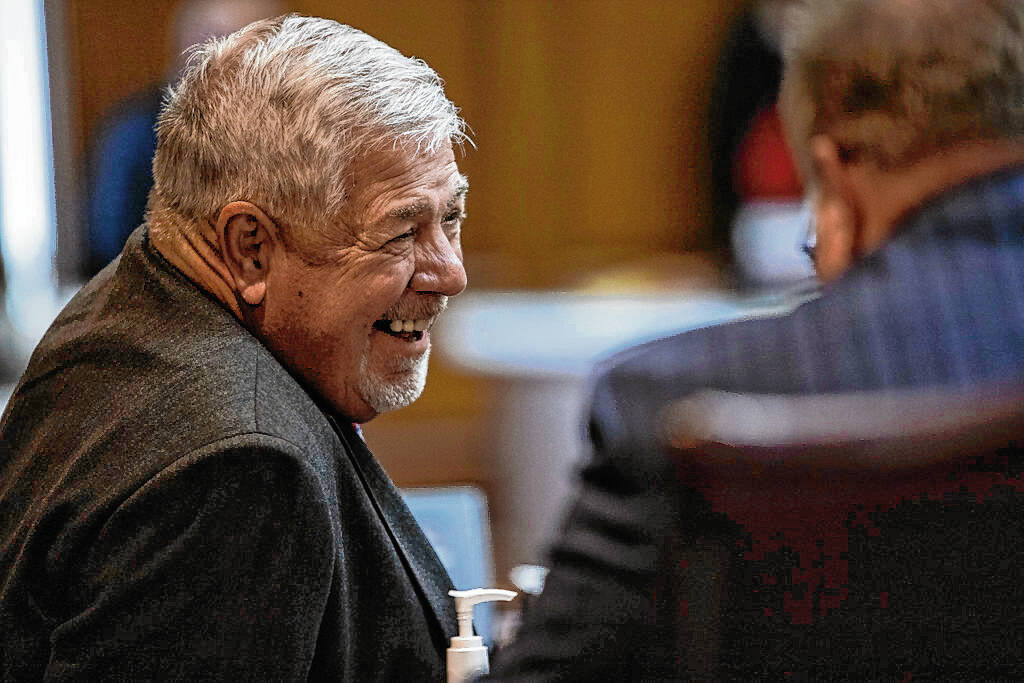

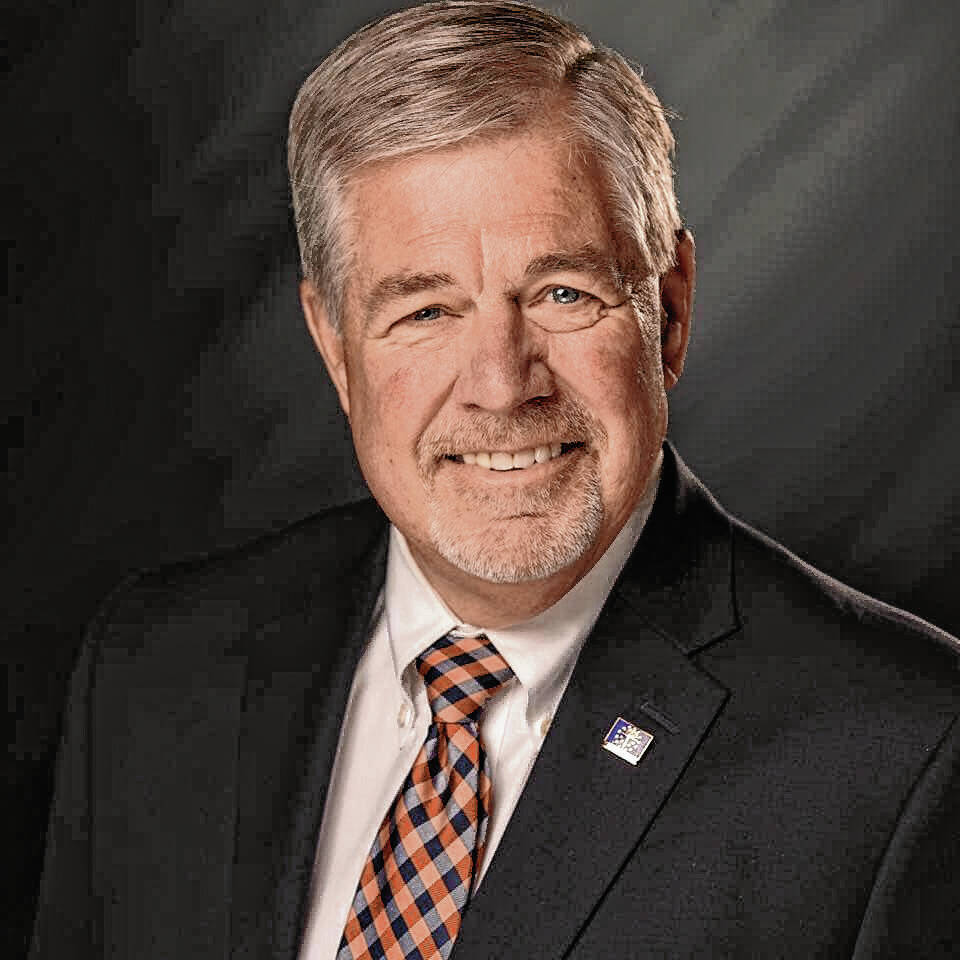

Bob Cherry (Republican) is a member of the Indiana House of Representatives, representing District 53, a position he assumed when he took office in 1998.

Bob Cherry officially announced his retirement from the Indiana House of Representatives on Friday, effective at the end of the upcoming 2024 session.

Hancock County’s Bob Cherry, (R) State Representative, says he’ll wrap up his political career after 25 years. He plans to make the up coming legislative session his last. He’s held office representing the county since 1998.

HANCOCK COUNTY — Longtime State Rep. Bob Cherry (R-Greenfield) — whose district includes parts of South Madison County — has announced his intention to retire from the Indiana House of Representatives.

After 25 years of service, Cherry said in a press release on Friday that he plans to retire next year from the Indiana House of Representatives after completing his term and will not seek re-election in 2024.

“During my time in the legislature, our state’s national economic momentum and outlook rankings have gone from near the bottom of nearly every recognized list to at or near the top,” Cherry said. “We also turned budget deficits into structurally balanced budgets with healthy reserves, which protect against future economic downturns.”

Cherry said he’s grateful to have been part of Indiana’s success story and for the strong conservative leadership that helped propel the state to where it is today.

“I’ve had the tremendous opportunity to serve with many great leaders in our caucus and in the governor’s office, and I’m grateful for the fellowship and friendships with legislators on both sides of the aisle,” he said. “It’s also been incredibly rewarding to help mentor new lawmakers as they navigate the challenges of the legislative process.”

Cherry represents District 53, which includes portions of South Madison County — including most of Pendleton — and a large part of Hancock County. He took office in 1998. His current term is set to end in late 2024, capping a 25-year political career in local and state government.

“It’s been a great privilege and honor to serve Hancock and Madison counties as well as portions of Rush and Shelby counties under the prior legislative district maps,” Cherry said. “I’ve been blessed to represent our area of the state, and I’m so thankful for everyone who supported me along the way.”

Cherry currently serves as vice chair of the House Ways and Means Committee, which is responsible for crafting Indiana’s two-year state budget. He also serves as an alternate on the State Budget Committee, and as a member of the House Agriculture and Rural Development Committee, House Elections and Apportionment Committee, and House Rules and Legislative Procedures Committee. Cherry is also chair of the State Fair Advisory Committee and a member of the White River State Park Development Commission.

“Bob is an integral member of our team as he brings a wealth of knowledge and experience to the table, particularly when it comes to working on budgeting matters,” House Speaker Todd Huston (R-Fishers) said in the release. “He also approaches tough issues with Hoosier common sense, and keeps the needs of his constituents and local communities top of mind.”

In 2023, Cherry co-

authored the new biennial state budget, which is expected to save taxpayers an estimated $430 million over the next two years via tax relief. Cherry said thanks to the acceleration of individual state income tax cuts, Hoosiers will have one of the lowest rates in the nation by 2027.

The many issues Cherry fought for include Indiana’s students, teachers and schools through helping to pass record investments in K-12 education. Under Indiana’s new budget, student funding increases by 10% over the next two years. In addition, Cherry supported the elimination of textbook and curricular fees for parents. Recently, Cherry successfully led efforts to ensure schools no longer lose significant funding when a student graduates high school early. Previously, schools were at a disadvantage as students who graduated early decreased student enrollment numbers, which are used in part to determine student funding.

This year, Cherry supported legislation to boost support for local fire service, which he said often struggles to purchase much-needed equipment, update training and meet staffing needs. Under a new law, counties can adopt a resolution for one or more township fire departments, volunteer fire departments, or fire districts and territories to receive up to .05% of their public safety local income tax. Cherry said this law gives locals a great option for a sustainable funding stream for fire service.

The Greenfield lawmaker also recently supported legislation to help counties better address growing operational and maintenance costs associated with county jails. Under the law, county councils can increase the local income tax by no more than 0.2% to help with county jail expenses.

In 2023, Cherry backed legislation to help small businesses by expanding eligibility for the business personal property tax exemption, allowing personal property up to $80,000, instead of $40,000, to qualify for the exemption.

In 2022, Cherry co-authored the largest tax cut in Indiana history, providing for a reduction in tax collection of $1 billion. The law also lowered utility bills for Hoosiers and businesses by eliminating the 1.46% Utility Receipts Tax paid on electricity, natural gas, water, steam, sewage and telephone bills.

That same year, Cherry, a grandfather of several female athletes, supported a new law to prohibit biological males from participating on girls K-12 sports teams at public schools in Indiana. Cherry said it’s critical to protect integrity and fairness in girls sports, including scholarship opportunities for female athletes.

Cherry, a lifelong farmer, advocated for Indiana’s agriculture industry and Hoosier farm families throughout his legislative career. In 2013, Cherry co-sponsored a law preventing $57 million in farm property tax increases by making an adjustment to the way assessments are calculated regarding soil productivity.

In 2005, Cherry supported legislation creating Indiana’s first tax amnesty program, which allowed Hoosier businesses and individuals who owed back taxes to the state an opportunity to pay what they owe, without a penalty. Cherry said the successful legislation helped Hoosiers while allowing the state to collect $244 million in unpaid taxes. In an effort to help make the state’s business climate more competitive, and spur innovation and growth for Hoosier small businesses and farmers, he supported phasing out the state’s inventory tax. The phase-out process began in 2002 as part of a tax restructuring package adopted by state lawmakers, followed by a complete elimination of the tax in 2007.

Prior to joining the legislature, Cherry served on the Hancock County Council, the Planning Commission and Greenfield Board of Zoning Appeals. He will continue to serve on the Indiana State Fair Commission.

Cherry and his wife, Deb, have five grown children and 12 grandchildren.